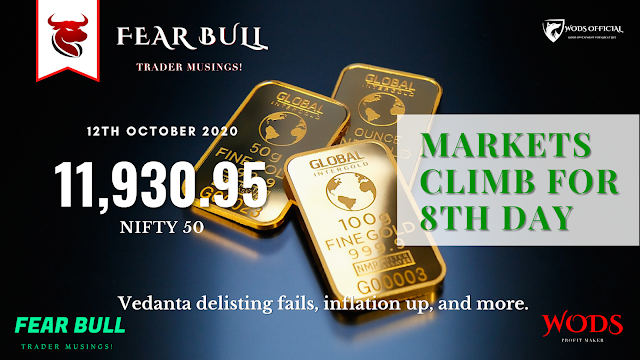

12th October 2020’s Highlights: Markets end in green, Vedanta delisting fails, inflation up, and more.

-12th October 2020-

Sensex 40,593.80 ▲ 0.21%

Nifty 11,930.95 ▲ 0.14%

Today, despite a strong opening, the Indian markets gave away most of their early gains, owing to selling in banking shares. The markets opened the day up by around 0.9% compared to the previous close.

Among the sectoral indices, the Nifty IT (+1.6%), Nifty Pharma (+0.9%) and Nifty FMCG (+0.3%) indices gained, while all other indices closed in the red. Infosys (+2.9%), ITC (+2.7%), UPL (+1.9%) and Dr Reddy's (+1.5%) were among the top gainers in the Nifty, while Bharti Airtel (-2.8%), JSW Steel (-2.7%), GAIL (-2.6%) and HDFC Life (-1.9%) were among the Nifty top losers.

However, towards the end of the day markets came down. Even then, the markets ended up by more than 0.15% - a slight rise compared to the previous day.

Top Gainers (Nifty)

ITC - Rs 172.20 ▲ 2.59%

Infosys - Rs 1132.10 ▲ 2.29%

UPL - Rs 507.10 ▲ 1.97%

Cipla - Rs 814.70 ▲ 1.42%

Asian Paints - Rs 2077.85 ▲ 1.33%

Top Losers (Nifty)

Bharti Airtel - Rs 415.05 ▼ 2.39%

JSW Steel - Rs 285.15 ▼ 2.35%

GAIL India - Rs 83.85 ▼ 2.16%

Tata Motors - Rs 135.85 ▼ 1.88%

HDFC Life Insurance - Rs 563.40 ▼ 1.81%

Here are the top stories of the day.

Vedanta Delisting Failure, Stock Dips 20%

Vedanta informed the exchanges this morning that its delisting process had failed. Because of the failure, the shares, according to SEBI’s regulations, will need to be returned to shareholders within a certain time period.

What is meant by delisting and what went wrong?

Delisting is the process by which a listed company stops the buying/selling of its shares on the exchanges. It can voluntarily do so or can be made to do it in case of violations. In the case of Vedanta, it was voluntary. According to delisting regulations, the promoter shareholding must cross 90%.

In case of Vedanta, to reach 90% shareholding, Vedanta’s promoters needed 134 crore shares tendered by the public. However, only around 125 crore shares tendered by the public shareholders were valid.

While there isn't much clarity on what went wrong with the validity, some reports say that investors tendered their shares at a heavily discounted price.

The company will have to announce the next course of action in the coming few working days. Stocks of the company fell 20.43% to Rs 96.95 per share.

Shares of Vedanta Ltd fell over 20% today after the company failed in its attempt to delist the stock from the exchanges. In a regulatory filing, Vedanta said its buyback offer is deemed to have failed as per the terms of the delisting regulations after promoter Vedanta Resources did not receive the required number of shares to delist the firm. Shareholders tendered a total of 125.47 crore shares against the 169.73 crore shares sought by promoters. Overall, the share price of Vedanta has dropped nearly 29% this month. Hindustan Zinc, in which Vedanta holds close to 65%, was also down 5% today. Recently, questions were raised regarding Vedanta’s decision to not distribute to its shareholders a dividend worth ₹4,500 crore, which it received from Hindustan Zinc.

Sovereign Gold Bonds (SGB) Opens for Tranche VII Today

This is the seventh tranche of gold bonds. It opened for subscription on October 12 and closes on October 16. The issue price of the bond has been fixed at Rs 5,051 per gram. The issue price for the previous tranche which was open between August 31 and September 4 was Rs 5,117 per gram.

As usual, there will be a discount of Rs 50 per gram for those who invest online.

What are SGBs?

SGBs are issued by the Government of India but are managed and supervised by the Reserve bank of India (RBI). These bonds have a term of eight years with a lock-in period of 5 years. The interest is fixed at 2.5% per annum and you do not get physical gold delivery after redemption.

Mazagon, UTI IPOs List in Markets Today

Two IPOs were listed in the markets today.

Mazagon Dock Shipbuilders

The company’s IPO had a price band of Rs 135-145 per share. It was oversubscribed by more than 157 times. The stock listed on the markets today. It ended the day at Rs 173 - up by around 19%.

UTI AMC

The company’s IPO had a price band of Rs 552-544 per share. It was oversubscribed by more than 2.2 times. The stock listed on the markets today ending the day at Rs 476 - down by around 14%.

The IPO market saw a mixed bag of returns as two of the recent IPOs listed on the exchanges today. The shares UTI AMC listed 11.5% lower than their issue price, whereas shares of Mazagon Docks debuted at a premium of 49% on listing day. The strong opening of Mazagon Docks didn’t come as a surprise given that the issue was oversubscribed by a whopping 157 times. Going by the dismal debut of UTI AMC, investors are likely to turn choosy in the upcoming IPOs.

Finance Ministry Announces Measures To Boost Consumer Spending

The Finance Minister announced measures worth Rs 73,000 crore to stimulate consumer spending:

LTC Cash Voucher scheme: Central government employees can opt to receive cash amount to leave encashment plus three times the ticket fare, to buy items which attract a GST of 12% or more.

Special Festival Advance Scheme: Apart from this, central government employees can now get an interest-free advance of Rs. 10,000, to be spent by 31st March 2021 on the choice of their festival.

Assistance to States: The government is issuing a special interest-free 50-year loan to states of Rs. 12,000 crore capital expenditure.

Enhanced Budget Provisions: An additional budget of Rs. 25,000 crore, over and above the Rs. 4.13 lakh crore announced in Union Budget 2020, will be provided for CAPEX on defence, roads, urban development, water supply and domestically produced capital equipment.

Macroeconomic indicators throw a googly

The Index of Industrial Production (IIP), which measures the change in the value of output produced by manufacturers, miners and power utilities stood at -8.0% for the month of August. While the figure for August is negative, it is quite a recovery from -57.6% recorded for the month of April. Going forward, one would expect further recovery owing to the relaxation of lockdown restrictions and the lower base (-4.3%) of September 2019. Meanwhile, the Consumer Price Index (CPI), which measures inflation at the consumer level, jumped to 7.3% in September, the highest in eight months. The figures were higher than the expectation of around 6.8%. The sharp rise could be attributed to inflation in food and beverages (9.7%), which faced supply disruptions during lockdown. If the inflation rate continues to rise, one would expect RBI to rethink its accommodative stance, which it has taken to trigger the economic revival.

Retail Inflation Reaches 8-month High

The consumer price index-based inflation for September is at 7.34%. It was 6.69% in the previous month. This is the highest inflation mark touched in 8 months and is above RBI’s target of 2-6%.

Food inflation in September was at 10.68% compared to the previous month’s 9.05%.

Closing bell

Finance Minister Nirmala Sitharaman today announced the government's plan to boost capital expenditure and stimulate consumer demand. However, the ₹73,000 crore stimulus failed to cheer investors, as the markets closed almost flat. Meanwhile, the India VIX has gained nearly 15% in the last six trading sessions, hinting at volatility in the days ahead. Investors seem to be banking on defensive sectors in volatile markets, as witnessed by the gains seen in the IT, FMCG and pharma indices, amid a broad fall in other sectors.

🥇 Gold: Rs 51,109 ▲ 0.76% at 6 PM

🥈 Silver: Rs 63,474 ▲ 2.71% at 6 PM

🔀 USD-INR Rate: Rs 73.27/USD ▲ 0.19%

Dow Jones: 28,586.90 ▲ 0.57% - Oct 9

Nasdaq: 11,579.94 ▲ 1.39% - Oct 9

HAPPY INVESTING

SEE YOU TOMORROW

Post a Comment

Post a Comment